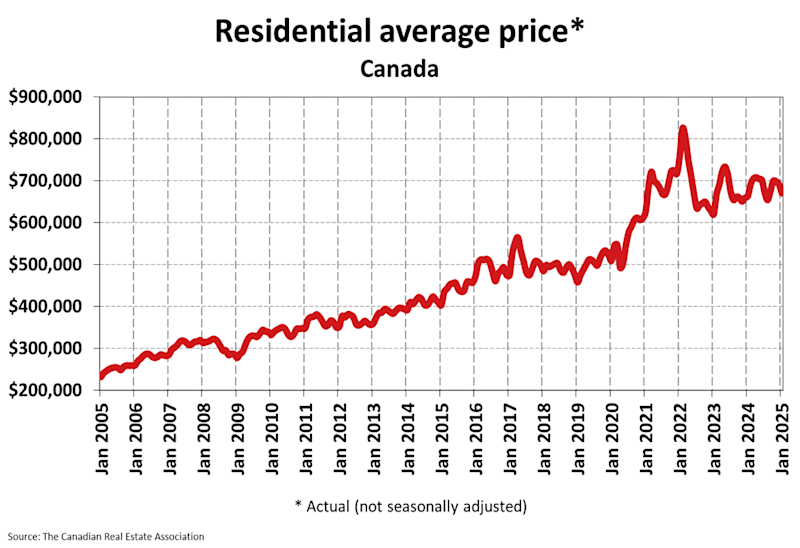

Trends in Canada’s Residential Real Estate: A steady rise in average home prices from 2005 to 2025, with notable surges post-2020.

Canada’s housing market may see a big comeback in 2025 as the Bank of Canada continues to lower interest rates. The central bank recently cut its key rate to 3% in its January 2025 decision, making it easier for people to buy homes. Experts believe this could lead to a busy year in real estate.

The Canadian Real Estate Association (CREA) predicts home prices will rise by 4.7% this year, with the national average home costing around $722,221 by the end of 2025.

Outside of British Columbia and Ontario, these kinds of price gains and some even larger ones are already well underway.

Shaun Cathcart, a senior economist at CREA, says lower interest rates, more home listings, and new housing projects could bring more buyers into the market, especially in the spring. Canada’s fast-growing population has increased demand for homes, but high prices have made it hard for many to buy. Now, lower rates might help more people afford homes.

However, the market will not grow the same way across the CREA predicts home prices will rise 4.7%, reaching $722,221 by yearend country. British Columbia and Ontario may see more home sales because there are more homes available. In Alberta and Saskatchewan, home prices may rise faster since there are fewer houses for sale and demand is already high.

Lower rates also affect mortgage holders. People with variable-rate mortgages will see lower payments right away, but those with fixed-rate mortgages may not feel the benefits as quickly. First-time homebuyers might find more options in the condo market, as many new condos will be completed

soon.

The Bank of Canada is expected to cut rates slowly and carefully, depending on inflation and the economy. Experts believe the interest rate could settle between 2.00% and 3.00% by mid-2025. While lower rates usually help the housing market, some buyers may still wait to see how the economy develops before making a decision.

As we move through 2025, the balance between interest rates, housing supply, and demand will shape Canada’s real estate market. The hope is that lower rates will boost home sales without causing long-term economic problems. The coming months will be key for those looking to buy or invest in property.